🔥 This offer expires in:

🔥 This offer expires in:

844-611-3328

The MCA Relief Guide:

For Business Owners Getting Crushed by Daily MCA Payments

11 Proven Strategies: How One Retailer Cut Payments By 58% And Settled 3 MCA Contracts In Under 6 Months

Without filing bankruptcy, begging your lender for mercy, or taking another predatory advance just to survive the week. Truths About MCA Debt is your battle-tested guide to cutting down $100K+ in stacked MCA debt — while protecting your business, your sanity, and your future.

TONY RIVERA

AUTO SHOP OWNER, DAD OF 2

I was drowning. Three MCAs, $3,800 a week going out, and nothing left for payroll. I thought bankruptcy was my only option. Getting this guide opened my eyes — now I understand how these lenders really work. I stopped the bleeding, cut my debt in half, and finally feel in control of my business again.

They Took $42K From His Account In 11 Weeks - All Legal. - Here's How He Got It Back.

Let’s get real.

If you’ve got stacked MCA loans bleeding your bank account dry — daily — then you’re not just “losing money.” You’re being legally robbed… with a contract you were pressured to sign under duress.

Sound dramatic? Good. Because this isn’t some slow-drip inflation problem.

This is your $50K advance turning into an $87K noose.

It’s 820% APRs.

It’s account sweeps without warning.

It’s waking up to find your Stripe account frozen and your payroll about to bounce.

All while the MCA lender pockets profits off your suffering — and laughs from their legal ivory tower.

But here's the twist: you’re not powerless.

This no-BS guide shows you exactly how real business owners are cutting 5-figure MCA debts by 40%... 60%... even 80% — without bankruptcy, and without another damn “consolidation” scam.

You don’t need a Wall Street degree. You need one letter.

One step. And one decision to finally stop playing by their rules.

Stop the Daily MCA Bleed

Daily ACH withdrawals bleed your cash flow dry faster than you can make sales. Most business owners think they’re just “riding it out” — but the truth? That $50K advance has already snowballed into $87K.

This guide shows how owners stop the drain, freeze collections, and buy back breathing room.

Unlock Legal Power Moves

Here’s the truth MCA lenders don’t want you to know: they’re counting on you not knowing your rights. This guide opens up the same legal pressure points that top businesses use to cut massive MCA debts — sometimes by 40%, 60%, even 80% — without bankruptcy. You don’t need millions. You just need the right moves.

Slash Stacked Loan Chaos

Stacked MCAs are the lenders’ jackpot… and your nightmare. While you juggle 3–5 advances at once, they’re multiplying interest and fees at rates that’d make loan sharks blush — sometimes 820% APR. We’ll show how business owners flip the script, slash stacked payments, and finally get lenders off their back.

Freedom In 5 Minutes

Getting out of MCA hell isn’t complicated. In fact, most of the work is just sending one strategic letter and following a simple plan.

We’ll show you how business owners are reclaiming their time, their revenue, and their sanity — often with less than 5 minutes of action a week once the process starts.

Your MCA-Crushing Edge Awaits.

Instant access: Your FREE complete MCA escape guide, delivered in seconds

A Proven System to Escape MCA Debt

Here’s what’s inside your guide:

Part 1: Stop the Bleed — Freeze daily ACH withdrawals, protect your accounts, and create instant breathing room so you can survive the week without another sweep.

Part 2: Slash the Balance — Use legal leverage to cut balances by 40–70%, just like we did for a Texas retailer who settled 3 MCAs in under 6 months.

Part 3: Secure the Future — Consolidate into one manageable payment, rebuild vendor trust, and restore your credit without filing bankruptcy.

Bonus Strategy: Permanent Protection Plan — Learn how to spot MCA traps before they happen, so you never fall back into predatory funding again.

How to Beat MCA Lenders at Their Own Game

Here’s what you’ll learn:

Intro: Why Most Business Owners Stay Stuck — MCA contracts are written to confuse you. In 8 minutes, you’ll know exactly how they trap you... and how to fight back.

Part 1: What to Look for (Before It’s Too Late) — Learn the exact red flags buried in your agreement that can be used against you — and how to flip them into leverage

Part 2: Your Debt-Slaying Gameplan — Step-by-step, we’ll show you how to craft a strategy that gets lenders off your back and puts you back in control — without courtrooms or bankruptcy

The Real Path to Financial Freedom

Here’s what’s inside:

Intro: Why “Freedom” Is a Lie When You’re Owed by 5 Lenders

We’ll show you why true financial freedom isn’t about passive income dreams — it’s about regaining control of your money and peace of mind first.Part 1: Break Free from the Debt Trap

Learn how business owners crushed 820% APR debts, negotiated settlements, and turned around years of MCA damage — without bankruptcy.Part 2: Rebuild What the Lenders Broke

Credit. Vendors. Staff. This section shows you how to pick up the financial pieces and build a business that can breathe — without constant withdrawals.Part 3: Secure Your Financial Future (For Real)

Once you’re out, we show you how to stay out — through smarter funding, vendor trust rebuilding, and cash-flow-first growth.

Launch Your Fightback Plan in 7 Days or Less

Here’s what you’ll execute:

Intro: Your Business Is Bleeding. This Stops It. We’ll walk you through the fast-start method used by real business owners to go from chaos to clarity — and take back control in one week or less.

Part 1: Map Your MCA Attack Plan

You’ll pick your strategy: legal settlement, forensic breakdown, ACH freeze, or all three. We’ll help you identify the fastest path based on your current lenders.Part 2: Launch the Escape

Now it’s go time. You’ll send the right letter, make the right move, and shut down the daily pain. Your first win could come within 48–72 hours (many have).

Your Recovery Roadmap: From Chaos to Cash Flow

Here’s what you’ll implement:

Part 1: The $2K/Month Cash Flow Plug

Discover how business owners reclaimed $2K–$8K/month in just weeks by reducing stacked MCA payments without taking another loan.

Part 2: Revenue Over Rescue Loans

We’ll show you how to generate real revenue (not desperate cash advances) using proven methods business owners are applying even mid-crisis.

Part 3: Keep What You Earn

Rebuild control with every dollar — vendor management, ACH protection, and client relationships that drive cash in, not debt out.

Get Our MCA Survival & Business Recovery Bundle - Free For Business Owners Fighting Back!

BONUS: The Business Recovery Game Plan!

This isn’t some generic checklist — it’s a strategic, 12-month plan built for business owners clawing their way out of MCA debt and back into profitability.

Rebuild cash flow without taking another loan

Restore vendor relationships and credit standing

Set up systems to keep your business MCA-proof

Finally get your time, sanity, and bank account back

Join Our Community of Success Stories

Verified Review

ISABEL RAMIREZ

Small Business Owner

"I used to think MCA payments were just the cost of staying afloat… until they started draining everything. This guide gave me a wake-up call. I followed the steps, paused the withdrawals, and finally got back in control. It feels like I’m running my business again — not just surviving."

Verified Review

RONALD MARTIN

Trucking Business Owner

"I’ve been in trucking 12 years — thought I’d seen it all. But those MCA loans? They hit harder than a freight bill in Q4. This guide helped me shut down the daily drains, negotiate a real plan, and finally stop bleeding cash. I’ve cut my payments by almost half. This thing’s a weapon."

Verified Review

JASON MILLER

Ecom Store Owner

"Stacked advances were choking my margins. I was doing $50K/month in sales but still broke. This guide showed me how to fight back — literally. I froze daily withdrawals, renegotiated terms, and actually started keeping my profits. If you’re buried in MCAs, don’t wait. This flipped everything for me"

Verified Review

TERRELL JONES

Ride Share Driver

"I took an advance to cover urgent car repairs… thought it’d help me stay on the road. Instead, the daily payments started eating into my gas money and groceries. I couldn’t breathe. This guide showed me exactly how to pause the bleeding and finally get ahead again. I’m driving with peace of mind now — not panic.

Verified Review

MIKE NAJJIR

Construction Contractor

"I signed one MCA to float payroll, then ended up juggling four. My account was getting hit daily — weekends, holidays, didn’t matter. This guide showed me exactly how to fight back. I stopped the withdrawals, negotiated down two balances, and got my crew paid without sinking the business."

Verified Review

Abbey Webber

Marketing professional

"I cut hair six days a week — but those MCA payments were cutting deeper. Every day they were pulling money before I even opened shop. This guide broke it all down in plain English. I used it, stopped the withdrawals, and finally started keeping what I earn. Real talk — this saved my business."

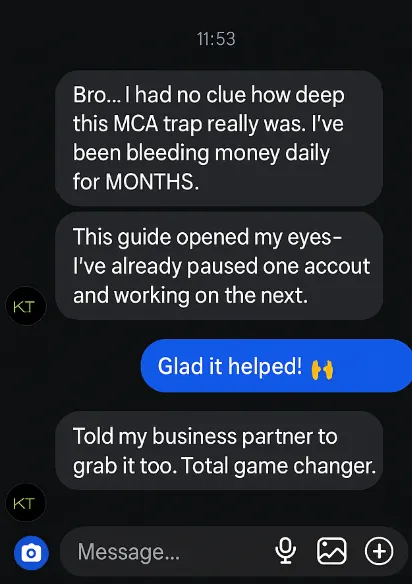

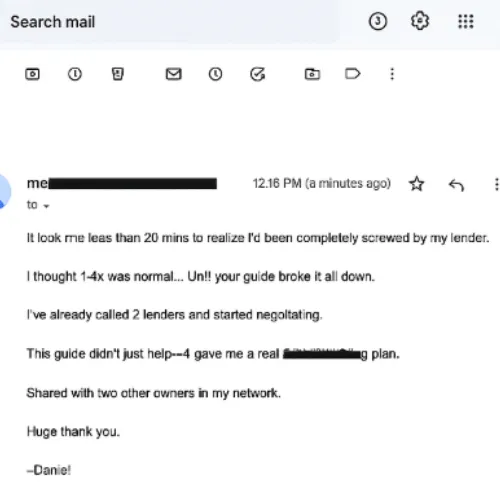

Want More? People Just Like You Send Us In This Everyday...

Download Your MCA Survival Playbook

This isn’t a bundle — it’s your escape plan. Inside: the exact strategies 1,200+ business owners used to stop daily withdrawals, crush MCA contracts, and take back control — without bankruptcy or upfront fees. For a limited time, grab the full system at a price that’ll make your lenders sweat. Your shot at real freedom? It’s right here.

TAKE BACK CONTROL

© Copyright 2025 - Debt Consultants Group - All Rights Reserved

Disclaimer: Debt Consultants Group does not provide loans or merchant cash advances. We provide educational resources.

Debt Consultants Group is not a lender and does not offer loans or credit cards. We provide educational resources and consulting services to help business owners better understand financing contracts and explore strategies for managing cash flow. This guide is for informational purposes only and should not be considered financial, investment, or legal advice. The content is based on research and experience and is intended to share general concepts and strategies. Individual circumstances vary, so you should consult a qualified financial advisor before making any financial decisions. We do not guarantee specific results, and all financial choices carry risk. Examples, figures, or scenarios provided may be illustrative or modified. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.